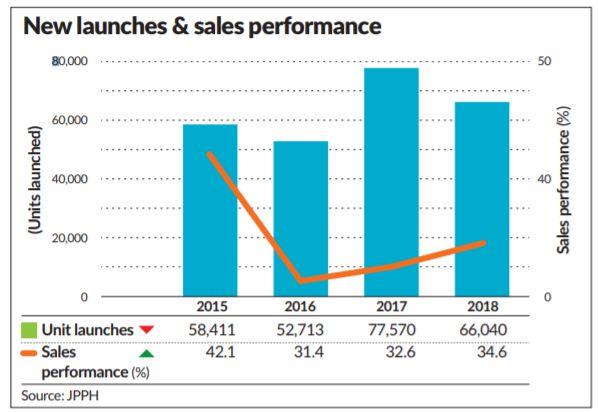

WHILE the level of residential overhang in the country continues to rise in spite of fewer launches last year, things may finally be looking up for the Malaysian property market.

According to the Valuation and Property Services Department (JPPH), the property sector recorded 313,710 transactions worth RM140.33bil in 2018, which was an increase of 0.6% in volume and 0.3% in value compared with 2017.

While the growth might be flattish, it’s a good sign, says Axis REIT Managers Bhd investments head and former Malaysian Institute of Estate Agents president Siva Shanker.

“I believe this is the lowest that it can go and I think we are essentially at the bottom of the u-curve,” he tells StarBizweek.

“At less than 1% growth, it’s a small positive but that’s good as it means the downward slide has stopped.”

Siva is optimistic the local property sector could see its “first real growth” since 2012.

“I believe that the new government is doing a great job. Yes, they have met resistance and unfortunately, politics trumps economics and a lot of times, it trumps common sense.

“As the new government carries on cleaning up the country of corruption, sentiment will start to pick up and I am optimistic we will see better growth in 2019.”

JPPH in its Property Market Report 2018 says property market activity in 2019 is expected to stabilise, judging from the increase in volume and value of total transactions in 2018.

“The commercial property segment will remain as the supporting sector in generating business activity and the pull-factor for investments.

“As Malaysia embraces Industrial Revolution 4.0 and the digital economy, a different arena is expected for the industrial property sub-sector to play a significant role generating investments and employment opportunities.”

The report says major infrastructure projects are expected to be the catalyst for development growth in the long run, adding that the property overhang issue needs to be thoroughly handled and a holistic measure needs to be in place.

At the launch of the report earlier this week, National Property Information Centre director Md Badrul Hisham Awang said residential volume increased 6.9% year-on-year in the first quarter of 2019, while the value also increased 5.1% in the first three months of the year compared with the previous corresponding period.

He attributed the market pick-up to the new government policies being introduced.

Rising overhang

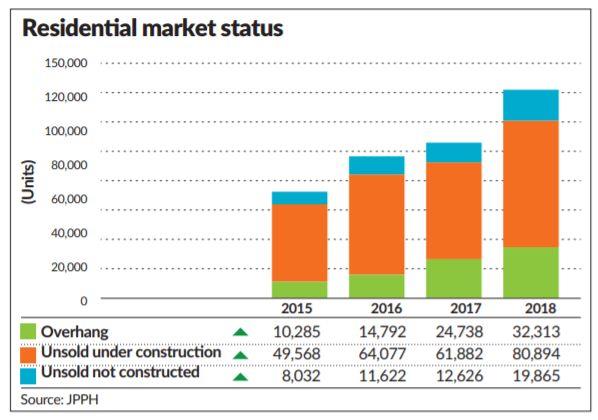

According to JPPH, the year-on-year residential overhang in Malaysia increased to 32,313 units valued at RM19.86bil in 2018, an increase of 30.6% in volume and 27% in value.

High-rise units formed the bulk of the overhang units, representing 43.4% (14,031 units) of the total.

“Most of them were concentrated in Perak (2,905 units) and Kuala Lumpur (2,692 units),” says JPPH.

Meanwhile, unsold, unconstructed units also increased y-o-y to 19,865 units, up by 57.3%.

Unsold, under-construction units also rose to 80,984 units, an increase of 30.9%.

JPPH in its report emphasises that overhang does not necessarily mean oversupplied.

“There are other contributing factors such as mismatch, affordability and costs of living. It is about finding the right location, right price, right type to cater for the right demand.”

Siva says the overhang can be reduced if developers stop offering the same products to the market.

“It’s time to stop building the same products and start offering alternative asset classes that will sell. Yes, it’s a difficult situation because it may not provide the quickest gains to developers.

“But as the supply slows, demand will start to absorb the oversupply.”

He says more emphasis needs to be placed on creating more demand.

“You should be building what people want in locations they want to stay in at prices that they can pay for. There’s no point in trying to continue selling something that people are not buying.”

Siva also applauds the government’s move to ease home financing. Last month, Finance Minister Lim Guan Eng said the ministry would take action if it were to receive any reports from developers on housing loan applications being rejected without strong justifications.

“I think if banks are less stringent in providing loans, it will ease the situation a little bit and demand for homes will rise,” says Siva.

JPPH also notes that the government has played its role to overcome the overhang issue by initiating discounts via the Home Ownership Campaign (HOC), which runs from January to June.

“Thus, government and the property players especially the developers need to join hands in ensuring that the overhang issue will not be aggravated further.”

The HOC was conducted twice for three months each time in 1998 and 1999. The campaigns included waivers for stamp duty on properties priced at RM250,000 and below as well as some processing fees such as the memorandum of transfer, to lessen the burden on homebuyers and to encourage home ownership. It should be noted that the previous campaign took place after the 1997/98 Asian Financial Crisis, where income was on the decline and there was poor market sentiment and job uncertainties – just like today.

However, house prices and the level of oversupply of condominium and high-rise units back then were nowhere near as high as that of today.

The government has announced a number of initiatives in conjunction with the six-months HOC, such as the exemption of stamp duties on residential units priced between RM300,000 and RM1mil.

These are only for properties of developers that are participating in the HOC.

For houses sold from RM1mil to RM2.5mil, stamp duty exemption applies for the first RM1mil, and the rest will be charged at 3%.

Previously, a 1% stamp duty fee was imposed on buyers for the first RM100,000 of the purchase consideration; 2% for RM100,001 to RM500,000 and 3% from RM500,001 to RM1mil.

Stamp duty on loan agreements for properties up to RM2.5mil would be exempted, compared with the previous rate of 0.5%. He added that properties purchased during the campaign would also be offered a minimum 10% discount. All the properties at the HOC will come with a minimum 10% discount and stamp duty waivers on the instrument of transfer and the instrument on loan agreement, as well as additional incentives from participating developers.

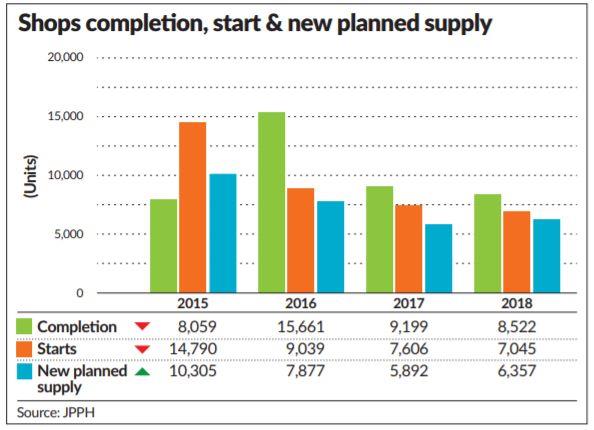

Shops and offices According to JPPH, the commercial property sub-sector recorded an increase in market activity.

“There were 23,936 transactions valued at RM29.51bil recorded, an 8% increase in volume and 16% in value. All major states show a better movement compared with the previous year.”

The report says Selangor led the market activities with 5,431 transactions (22.7%), followed by Kuala Lumpur with 4,079 transactions (17%), Johor (3,504: 14.6%) and Penang (1,304: 5.4%).

“Shop sub-sector transactions dominate 54% of commercial property transactions and 36% of the total value, recording a positive movement of 5% in volume and 11.5% in value compared with 2017 (12,310 transactions worth RM9.63bil).”

JPPH adds that the shop overhang situation recorded an increase of 11.2% to 5,055 units valued at RM4.08bil.

“Unsold under construction recorded similar upward trends to 7,233 units compared with 5,889 units in 2017, an increase of 22.8%. On a brighter note, unsold, unconstructed units reduced by 16% (385 units).”

On the outlook for this sector, Knight Frank Malaysia in its 2019 Malaysia Commercial Real Estate Investment Sentiment Survey says that favourable factors affecting commercial real estate investment sentiment are strong influx of foreign direct investments in the manufacturing sector and the rapid adoption of Industry 4.0.

“Respondents generally regard the smooth transition of power to the Pakatan Harapan coalition and improved corporate / public governance to be positive for the commercial real estate market.

“In contrast, a number of respondents opined that limited access to funds resulting from stringent lending guidelines coupled with a slowdown in the economy will dampen prospects for commercial real estate in the country.”

Knight Frank Malaysia adds that while respondents were generally satisfied with the provisions of Budget 2018, a relatively high number of them were dissatisfied with Budget 2019, citing a lack of catalytic measures to spur the nation’s weak commercial real estate market.

“Respondents are expected to take a conservative approach on investment in 2019 given challenges in the real estate market with weak return and yield coupled with limited available investment opportunities.”

Separately, JPPH says there were 29 office buildings transacted at RM1.19bil recorded in 2018.

“Kuala Lumpur recorded eight transactions and Selangor recorded seven. Other transactions include five in Sabah, four in Penang and one each in Johor, Perak, Sarawak, Labuan and Putrajaya.”

Knight Frank Malaysia says developers will be building less office, retail and hotel properties in 2019.

“Those specialising in logistics / industrial and healthcare / institutional segments will, however, continue to remain active.

“While pockets of opportunities may still be present in selected office sub-markets, the overall outlook is gloomy moving into 2019 with the majority of respondents expecting occupancy and rental rates to fall. There is no immediate catalyst to address the growing mismatch in supply and demand,” it says.

Meanwhile, the office rental market in most major states saw a stable performance last year, says JPPH.

“Several office buildings in Bangsar, Kuala Lumpur witnessed double-digit growth. While in Selangor, office buildings in the city’s transit hub or nearby location received more demand and enjoy higher rental rates.”

Retail sector

JPPH says the retail sub-sector recorded stable performance in 2018, with a decrease in average occupancy rate of 79.3% (2017: 81.3%).

“The decline was due to negative take-up in several states especially in Selangor and Pahang.”

Malaysian Association for Shopping and High-Rise Complex Management past president Richard Chan says the decline was due to the entrance of new malls that had been under-performing.

“Its these under-performing malls that has weighed down the entire sector,” he says.

JPPH says six shopping complex transactions worth RM237.24mil were recorded in 2018, namely two each in Johor and Perak and one each in Terengganu and Kelantan.

“The main transaction is Mydin Mall in Wakaf Tembesu, Kuala Terengganu, which transacted at RM155mil in 2017 but concluded in 2018.

An analyst says he expects the retail local retail sector to remain stable in the second quarter of 2019, underpinned by the Hari Raya festive season which will spur spending.

“We believe that the food and beverage (F&B) sector will continue to perform well in the second quarter,” he says.

Chan says he expects the local retail sector to remain stable this year.

“Except for maybe fashion retail, F&B has been doing well,” he says.

JPPH says rentals of retail space in major states were stable in 2018 for most shopping complexes.

“Most of the rental increments is due to tenancy renewals and rental revisions,” it says.

Knight Frank Malaysia in its sentiment survey says the performance of the retail sub-sector is expected to be lacklustre with respondents expecting a more challenging market ahead, in light of the high supply pipeline of retail space.

According to reports, it has been forecast that some 40 malls are slated to enter Greater Kuala Lumpur by 2020. There are already about 250 malls in the Klang Valley currently.

During a presentation at the 12th Malaysian Property Summit 2019 in February, Savills Malaysia head of retail services Murli Menon said that online retail is creating a structural shift, adding however that the bulk of retail sales will still take place in stores.

“We’re seeing a return to a customer-centric approach where engagement and convenience is important, but not the channel of purchase.”

However, he asserts that physical stores will continue to play an important role in the retail segment.

“Today, two in three retailers share inventory applications across their store and online channels. Retailers are rapidly moving away from multiple channel-specific commerce platforms, from 66% of retailers in 2011 to 44% currently.

“Around 61% of retailers currently use the store as a delivery hub for online orders.”

He adds that around 57% of retailers currently have store-specific social media initiatives to engage with customers.

“Around 64% of retailers plan to increase social media usage to encourage two-way communication with customers, while only 24% provide special customer service based on membership levels.”

In its latest retail industry report, Retail Group Malaysia (RGM) says it expects a 4.5% growth in retail sales to RM108.30bil in 2019 for the local market.

For the first quarter, it expects the retail industry to recover and expand by 3.1%, with pharmacy and personal care expanding the fastest by 12.7%, followed by department stores at 7.6%.

RGM says the overall retail industry is expected to recover and grow at an estimated 4.8%, underpinned by the Hari Raya festival taking place during this period.

During the third quarter of this year, retail sales are expected to expand by 3.9%. More activities during the second half of this year should boost retail sales during the final quarter of this year. During the year-end period, retail sales should rise by 5.8%,” it says.

Industrial sector

The industrial property sub-sector recorded 6,032 transaction worth RM15.01bil in 2018, which was an increase of 5.4% and 28.9% in volume and value respectively, says JPPH.

It says the level of overhang in this sub-sector continued to increase, recording a total of 1,183 units with a total value of RM1.98bil.

Siva says the bulk of the overhang is from the small cookie-cutter units such as terraces and semi-Ds, which are in fact in oversupply.

“A lot of these units are actually bought by investors and speculators, who plan to buy and then flip (for a higher price).

Much like the residential segment, he says many of these speculators may have problems either securing a loan or getting a tenant to rent out the place when the units are ready.

Meanwhile, unsold, under construction recorded a decrease of 11.4% compared with 2017, says JPPH.

“Johor still dominated most of the overhang units with 48.9%,” it says.

JPPH adds that the prices of industrial property showed a mixed performance.

“Johor recorded several negative, double-digit price changes, especially in the Tampoi area. While in Penang, property in Barat Daya showed a better price change due to limited supply for the property type.”