Malaysians are currently prioritising bread-and-butter issues over big-ticket items with increasing uncertainty in the face of unprecedented sociopolitical and economic change, amid the ongoing Covid-19 outbreak but this is likely to be short term.

Analysts foresee domestic and global recession but when it comes to real estate, market experts anticipate corresponding effects on home seeker sentiment to be short-lived, with prospects for recovery in the near term.

PropertyGuru Malaysia country manager Sheldon Fernandez said while this dampened sentiment led by Covid-19 is likely to persist through to the second half of this year, measures like the Economic Stimulus Package (ESP) and Bank Negara Malaysia’s (BNM’S) six-month moratorium on financing payments are laying the foundation for the market to bounce back.

“For those struggling to make ends meet, these measures help address the costs of living while presenting an opportunity to rebuild savings. For those with leverage, it may be a good time to invest,” he said.

Fernandez said sentiment among home seekers was already in decline at the start of the year, with the PropertyGuru Malaysia Consumer Sentiment Study H1 2020 reporting a drop in the Property Sentiment Index to 42 points, down from 44 points in the corresponding period last year.

He said this will likely see a fall in home loan applications, despite catalysts such as BNM’s recent revision of its Overnight Policy Rate (OPR) to 2.50 per cent.

Other markets experiencing Covid-19 outbreaks have seen mortgage applications drop by as much as 30 per cent, he said.

Fernandez said beyond these short-term impacts, research by property data analytics and solutions provider MyProperty Data Sdn Bhd underscores the property market’s resilience in the face of prior economic downturns and viral outbreaks, notably the severe acute respiratory syndrome (SARS) epidemic of 2002.

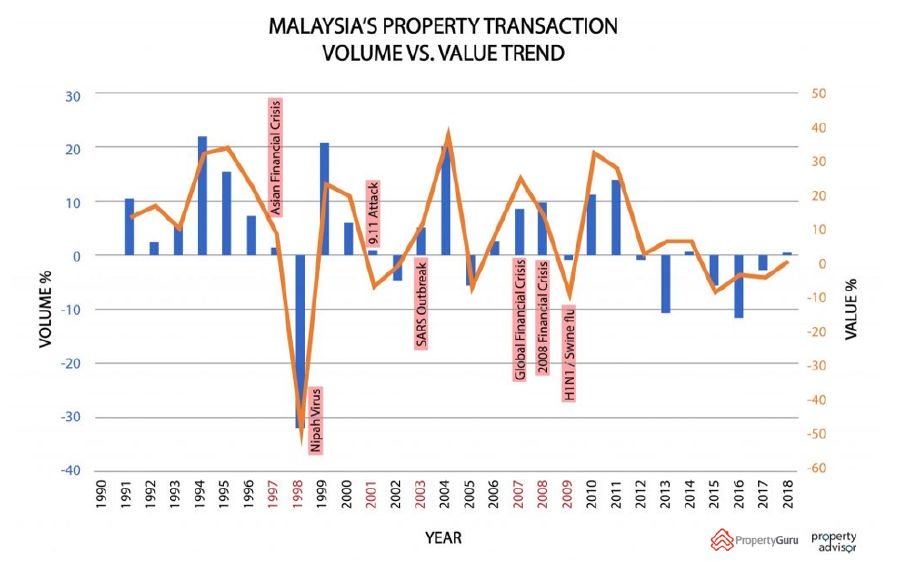

"Whether in terms of price, transaction volume or value, the property market has repeatedly showcased a tendency to bounce back immediately following a downturn. This is seen in surging transaction volumes and values in the years following the Asian financial crisis in 1997 and Nipah virus outbreak, SARS, as well as the global financial crisis in 2008 and H1N1 outbreak."

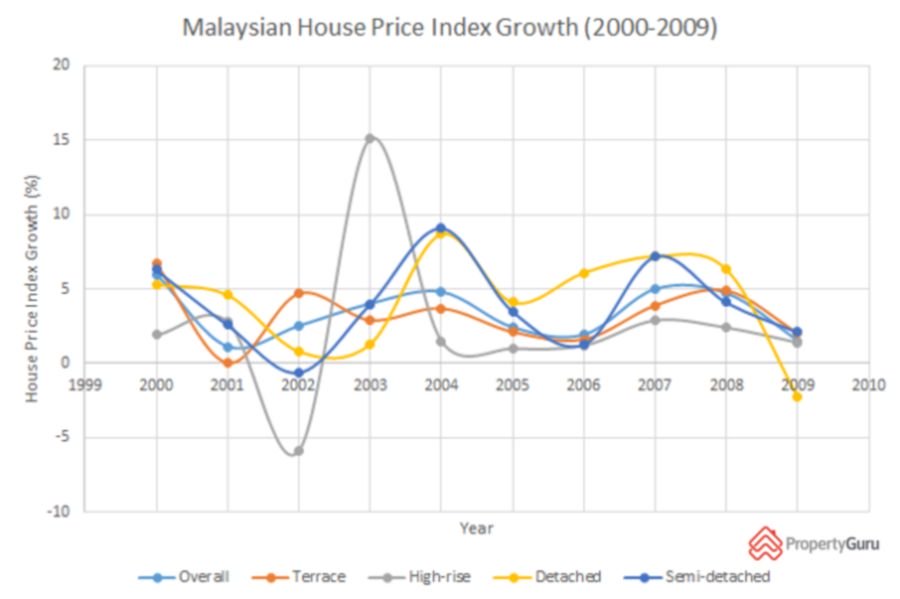

Fernandez said similar recoveries are also seen in national house price growth in the years following 2001, 2006 and 2009.

“Price growth, as well as transaction volumes and values, have slowed down in recent years, with measures in place to address the residential overhang. This may cushion potential impacts on the market as it rolls with the blow,” he said.

The resilience of property

Fernandez said property transaction volumes and values have remained strong throughout periods of uncertainty (see Chart A).

Chart A - Property transaction volume vs value growth (Source: MyProperty Data, NAPIC data)

Fernandez said the 1998 recession, in conjunction with the outbreak of the Nipah virus, saw volumes and values declining by 32.3 per cent and 47.6 per cent respectively, the largest downturn in recent decades.

“However, the industry still moved forward, with 186,000 transactions worth RM27.9 billion. Also, house prices as a whole have only continued to grow over the past few decades, highlighting the merits of property as an asset class.”

According to the National Property Information Centre (NAPIC), the national house price index has not exhibited an overall decline since 1999, though its growth moderated to a low of 1.1 per cent in 2001.

In terms of property types, high rises exhibited the most volatility in prices from 1999-2009, from a high of 15.1 per cent growth in 2003 to a low of –5.9 per cent the previous year (see Chart B).

Chart B - Malaysian House Price Index Growth (2000-2009) (Source: PropertyGuru Analytics, NAPIC data)

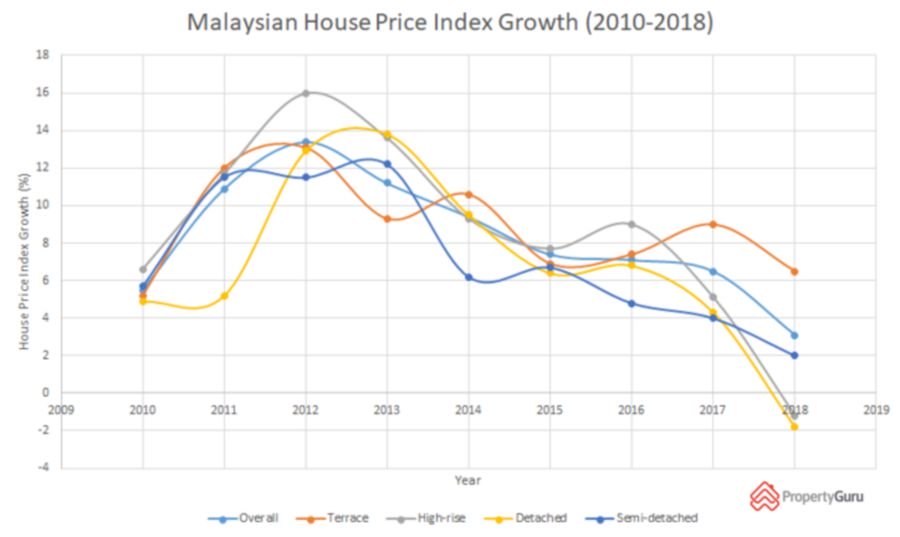

From 2009 to 2018, this volatility spread to other property classes such as detached and semi-detached homes. Since 1999, terrace homes have shown the most stability and consistent price growth among property types, with prices in the segment growing by 6.5 per cent in 2018 (see Chart C).

Chart C - Malaysian House Price Index Growth (2010-2018) (Source: PropertyGuru Analytics, NAPIC data)

"As such, terrace homes will likely be a key focus for property seekers moving forward. The PropertyGuru Malaysia Consumer Sentiment Study H1 2020 report found that terrace homes are the residence of choice among most Malaysians," said Fernandez.

Based on the research by MyProperty Data, it shows that terrace homes emerged as the clear favourite in Greater Klang Valley from 1999 to 2004, in terms of transaction volumes.

"Kuala Lumpur saw high demand in luxury condominiums and service apartments throughout these crisis years. High-rise properties were also popular in Penang, particularly lower-end apartments and flats. For Selangor, it was the city fringe, with terrace houses in Subang Jaya, USJ and Putra Heights as the hottest market.

"Median prices went from about RM220,000 in 1999 to up to RM400,000 by 2004. Around which time, demand similarly progressed to Setia Alam, Klang and other outlying areas towards 2012,” said MyProperty Data chief executive officer, Joe Hock Thor.

Joe said developers like Sime Darby, SP Setia, Gamuda Land, and IOI Properties caught the wave perfectly, where they build larger homes within master-planned townships at prices found closer to the city.

"High-rise popularity in Kuala Lumpur over this period picked up post-2003 and this may have been due to cashed-up investors taking the opportunity to pick up glossy headline properties at discount prices. This resulted in substantial price appreciation, with median high-rise prices rising from RM350,000 in the fourth quarter of 2003 to RM765,000 in the fourth quarter of 2009," he said.

Fernandez said moving forward, investors tend to restructure their portfolios in uncertain times to manage risk, with property as a potentially lucrative venture.

This, along with natural corrective forces as the market regains equilibrium, may account for the sharp recoveries seen in a domestic property following crisis years.