The ongoing oversupply of residential properties in Malaysia is seeing projects in the primary market losing their lustre, according to the PropertyGuru Consumer Sentiment Survey H1 2019.

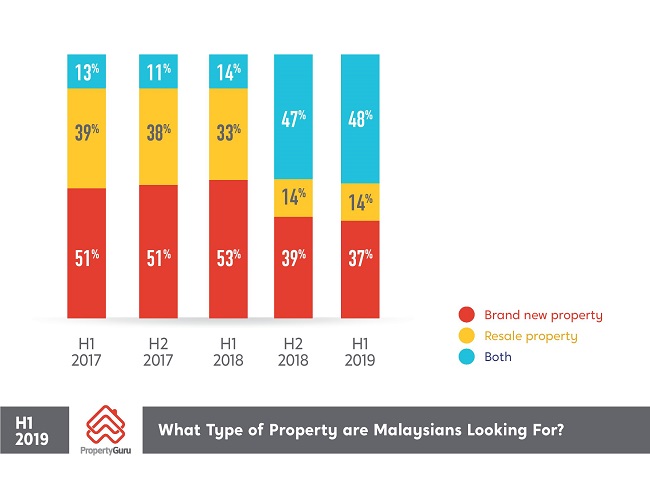

While more than half of respondents shared that they intend to purchase a property in the next six months, the report highlighted a year-on-year drop in exclusive interest in the primary market from 53% in H1 2018 to just 37% in the first half of this year.

This was accompanied by a rise in overall interest in subsale properties from 47% to 62% of respondents over the same timeframe. This figure includes purchasers interested in both secondary and primary market properties, which comprised 48% of respondents in H1 2019.

Changing Consumer Preferences

“Malaysians are becoming more flexible in terms of the kind of properties they are looking for. Just a year ago, new launches were the clear favourite, accounting for the majority of interest, with just 14% of home seekers willing to consider the secondary market as well,” said Sheldon Fernandez, Country Manager, PropertyGuru Malaysia.

“Today, 48% of Malaysians are looking for both new and subsale properties, with 14% exclusively targeting properties in the secondary market. This may underscore the growing disparity between new project launches and actual demand, whether in terms of pricing, location or other considerations.”

The introduction of the national Home Ownership Campaign (HOC) earlier this year – and its extension to 31 December – is not seen as a direct contributing factor, as its incentives and exemptions are designed to ease the country’s residential overhang in the primary market.

As such, there have been calls by industry watchdogs such as the Malaysian Institute of Estate Agents (MIEA) for the extension of the HOC to subsale properties. According to National Property Information Centre (Napic) data, the secondary market accounts for 80% of all property transactions in the country.

“This shift in preferences for subsale properties predates the HOC, with exclusive interest in the primary market among PropertyGuru Consumer Sentiment Survey respondents falling to 39% in H2 2018,” said Fernandez.

“It’s possible that location is the driving factor behind these changes, with purchasers prioritising older projects in central, more mature townships. Another factor which may play a role is immediacy, as subsale properties are available for home seekers to move into right away.”

Silver Linings For Demand

While consumer preferences may have shifted from the primary to the secondary market, purchasing patterns remain steady, with established suburbs and satellite townships surrounding city centres continuing to account for the majority of demand.

“We look into two areas of interest: current residence and intention to purchase. In both respects, Klang Valley and its associated neighbourhoods ranked at the top of the list for Consumer Sentiment Survey respondents,” said Fernandez.

In terms of current residence, most (52%) respondents are located in Klang Valley. Of these, 12% reside in Petaling Jaya, with Shah Alam and Subang Jaya (both 10%), the Kuala Lumpur city centre (8%), Cheras and Puchong (both 7%), Ampang (6%) and Damansara (5%) popular among respondents as well.

These patterns are reflected in purchasing intentions, with 62% of respondents targeting properties in Klang Valley. These respondents placed the following areas and townships highest in terms of buying interest:

- Petaling Jaya

- Subang Jaya

- Damansara

- Shah Alam

- Cheras

- Kuala Lumpur City Centre

- Puchong

- Bangsar

- Ampang

- Mont Kiara

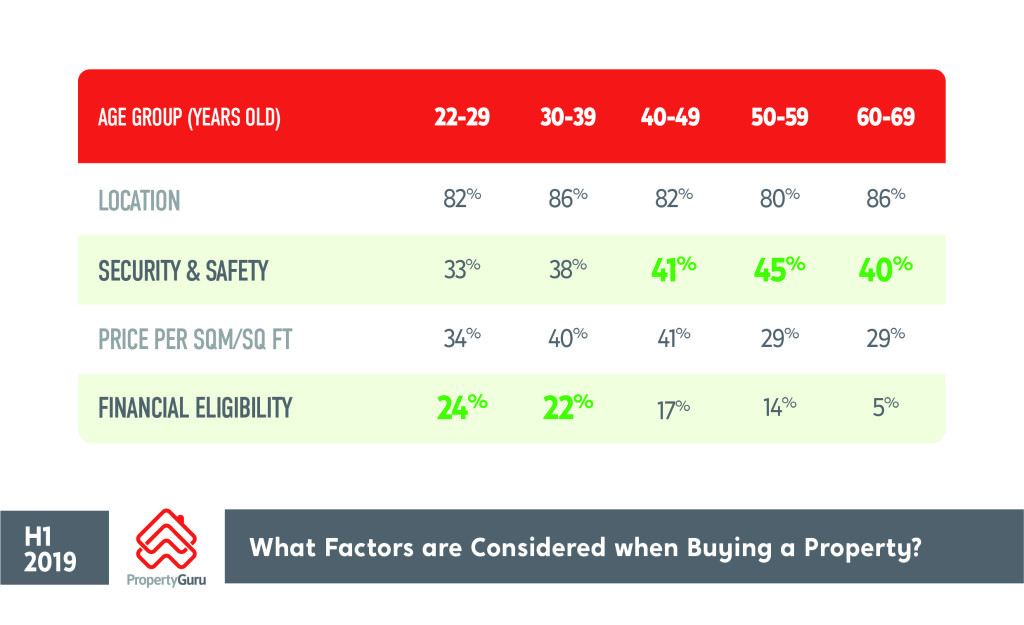

In addition, the Consumer Sentiment Survey H1 2019 findings highlighted the differences in purchasing behaviours between younger and older home seekers.

Source: PropertyGuru Consumer Sentiment Survey H1 2019

For the age group from 22 years to 39 years old, financial eligibility and price per square foot were core factors in decision-making, as reported by approximately 23% and 37% of respondents in the demographic respectively.

However, for those from 40 to 69 years old, security and safety were the key concerns, as cited by approximately 42% of respondents in the group. Location was a primary consideration across the board, with about 82% of respondents in both demographics reporting it as a priority.

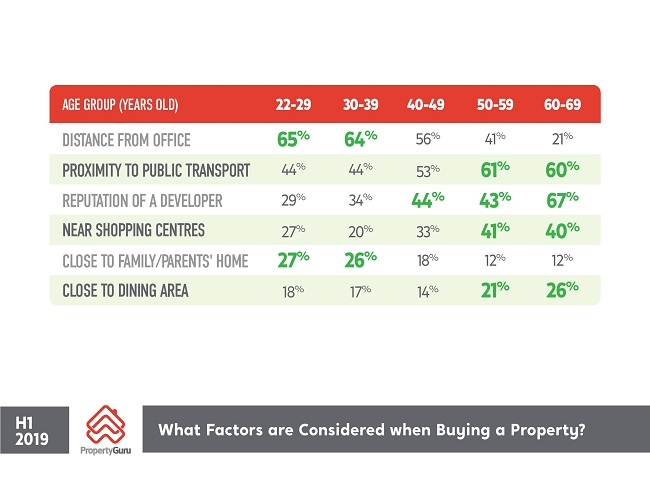

Locational preferences varied markedly by age as well. Younger purchasers desired homes close to their workplaces and families, while older home seekers looked for projects near public transport, shopping centres and dining outlets.

Source: PropertyGuru Consumer Sentiment Survey H1 2019

“Savvy developers are offering home seekers more options when it comes to the types of units available, as well as their features. We’ve seen a lot more granularity there as industry players cater for different segments of the market, and of course unit sizes have been shrinking to lower barriers to entry for younger purchasers,” said Fernandez.

“In terms of financial eligibility, numerous home ownership initiatives have been launched to assist home buyers in overcoming these hurdles. These include our very own PropertyGuru Home Loan Pre-Approval, which allows users to know their home loan eligibility ahead of time, avoiding the pitfalls of loan rejection.”

Market Sentiment On The Mend

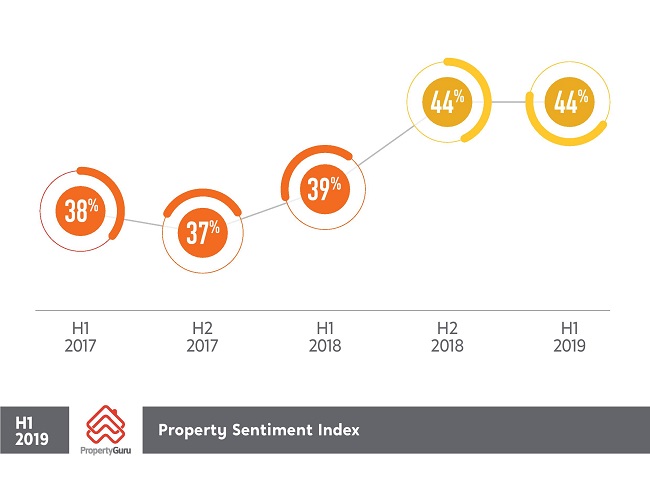

Looking at broader market direction, the recent PropertyGuru survey found that sentiment had improved year-on-year, with the Property Sentiment Index rising from 39 in H1 2018 to 44 in H1 2019.

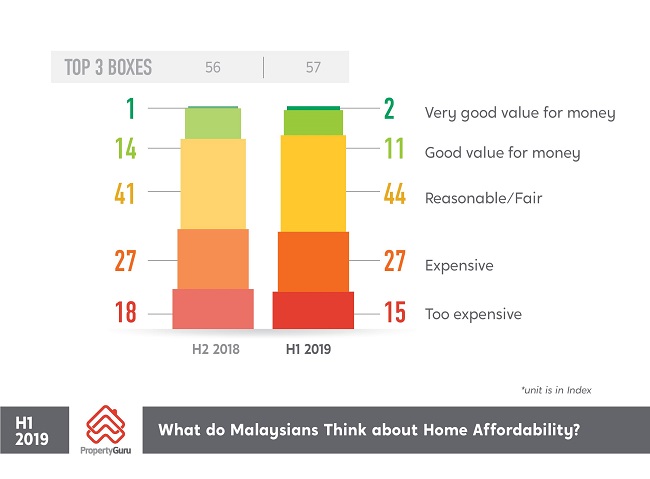

“We attribute the increase in performance to incremental improvements in terms of sentiments on affordability, as well as outlook on the current real estate climate. In particular, more home seekers are considering purchasing domestic properties, following a downturn since the latter half of 2017,” said Fernandez.

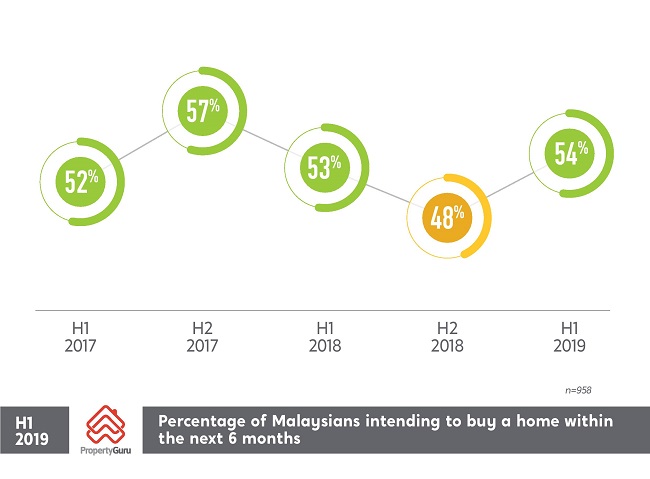

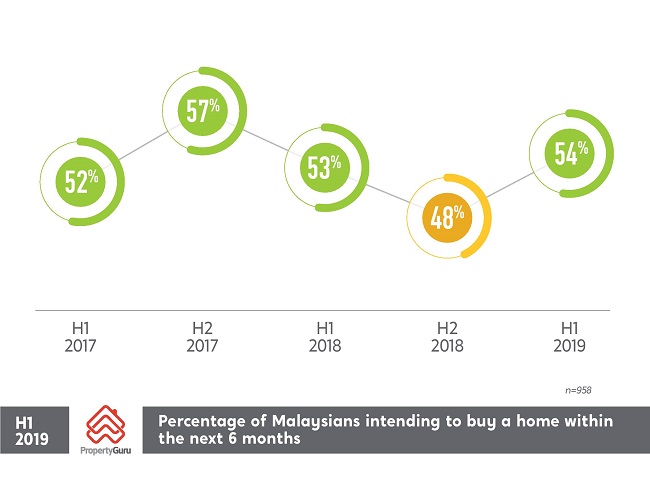

The percentage of respondents interested in buying locally declined from 57% in H2 2017 to 48% in H2 2018, with a possible correlation to the uncertainty surrounding Malaysia’s 14th general election in May that year. It has since returned to pre-election levels of 54%.

Source: PropertyGuru Consumer Sentiment Survey H1 2019

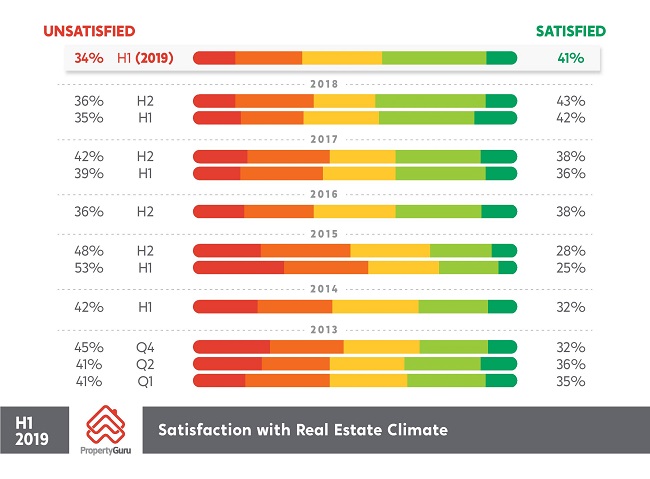

In addition, overall positive perceptions of the real estate climate in the country have steadily risen in the past few years, from a low of 25% in H1 2015 to 43% in H2 2018. This year, satisfaction declined marginally to 41%, though the long-term trendline is still on the upswing.

Source: PropertyGuru Consumer Sentiment Survey H1 2019

“As a whole, with the introduction of initiatives such as the HOC, which has already been extended to 31 December this year with proposals to broaden its purview to next year, as well as to the secondary market and even international purchasers, sentiment is on the mend,” said Fernandez.

“However, danger points such as pricing and financing should be addressed for the market to achieve sustainability in the long term, rather than relying on interventions such as the HOC.”

The PropertyGuru Consumer Sentiment Survey H1 2019 was based on a sample group of 958 respondents, responding to online questionnaires. Conducted since 2009 and implemented in collaboration with international research agency Intuit Research Consultants, the survey’s respondents primarily comprised professionals, managers, executives and businessmen (47%) in the mid to high-income segment (86%).