In an effort to spur the growth of the property market, real estate association, the Malaysian Institute of Estate Agents (MIEA) has urged the government to extend the incentives offered during the Home Ownership Campaign (HOC) to first-time home buyers in the secondary market.

“Consumer preferences may have shifted from the primary to the secondary market as the demand started to grow year-on-year.

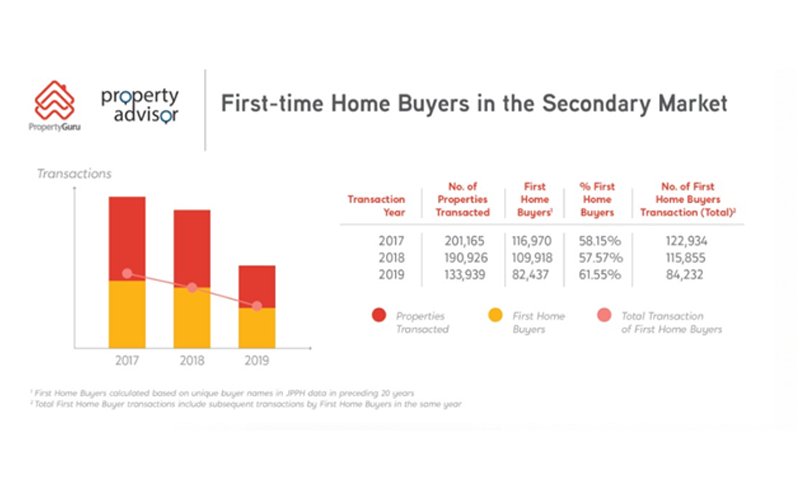

“This is evident from the statistics (attached below), that first-time home buyers (FHB) in the secondary market have increased to 61.55% in 2019 as compared to 57.57% a year ago,” MIEA president Lim Boon Ping told Property Advisor.

In 2019, the number of properties transacted stood at 133,939 and out of that 82,437 was the FHB in the secondary market.

However, the number of properties transacted in 2018 was higher by 56,987 but the number for the FHB in the secondary market was lower by 4%.

“So, with this evidence, why would the government want to channel the incentives to the new projects only?

“We addressed this issue during the recent meeting with the Ministry of Housing and Local Government as well as the Ministry of Finance. During the meeting, we proposed to extend the HOC’s incentive to the secondary market and stated that the sub-sale market has vast potential to grow.

“However, the government disagreed. So we will continue to appeal to the government. They should give an equal option to the FHB for both primary and secondary properties.”

Property consulting firm, Firdaus & Associates Property Professionals founder and managing director Sr Firdaus Musa said the government should at least provide stamp duty exemption for the secondary market due to the increasing demand.

“I believe the government’s main focus is to reduce the existing and potential overhang. At the same time, the government also needs to introduce stringent market studies to ensure the general health of the property market as well as to curb unnecessary new projects in the future.”

He noted the government’s incentives are mainly for new projects with smaller types of houses which do not cater to the FHB’s needs, especially those with younger kids.

“Roughly the only property they can afford for now is studio or smaller units. That’s why you can see a spike in secondary properties where most are cheaper and compatible with their needs.

“When Bank Negara Malaysia (BNM) reduced the overnight policy rate (OPR) by 50 basis points to 2%, it provided a huge impetus. Hence, the secondary properties are more attractive based on location and type. This segment is rapidly growing in demand and has been very active for the past three weeks,” he said.

Meanwhile, he also mentioned that the number of properties transacted for the FHB in the secondary market started to decline from 2018 to 2019, which may have been linked to factors such as location, long term commitment, debt service ratio (DSR), type of property, including personal readiness versus lifestyle.

“Ultimately, the main reason would probably be affordability and type of property.

“Most FHB would want a family-type dwelling with at least three bedrooms. These dwelling types are a popular choice among families with younger children, in which compatibility and affordability are huge factors.

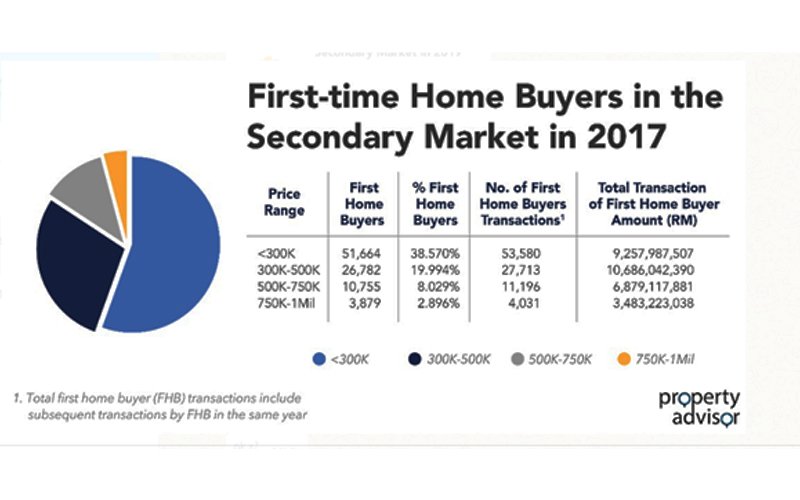

Based on Property Advisor’s analysis, the year 2017 saw a huge number of FHBs, with a total of 96,520 transactions from 93,080 buyers.

From these FHBs, more than half of the properties they purchased were priced below RM500,000, with 38.57% of houses below RM300,000 and 19.9% priced between RM300,000-RM500,000.

The statistics also showed that 8.02% of the FHBs purchased properties between RM500,000-RM750,000, however, only 2.89% bought properties between RM750,000 to RM1 million.

The amount transacted for the FHBs in 2017 totalled RM30.3 billion.

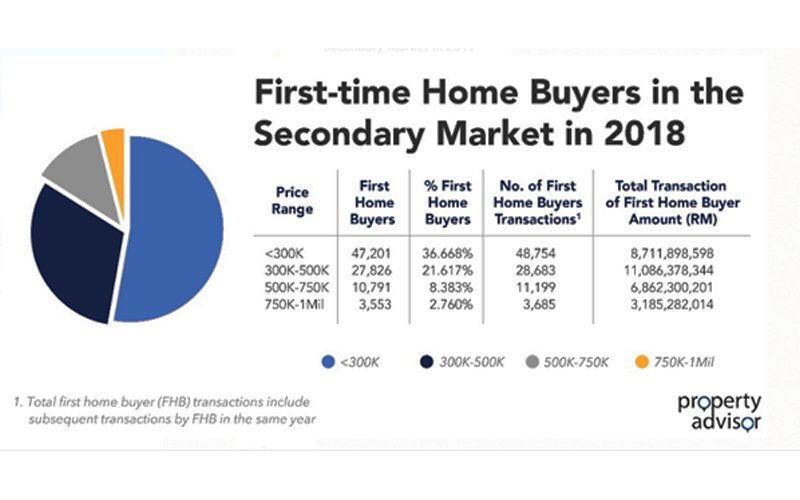

Meanwhile, in 2018 the total number of FHBs declined by 4.35% to 89,371, with 92,321 properties transacted.

However, taking a closer look at the statistics, the percentage of FHBs in the RM300,000-RM500,000 range saw an increase of 1.62%, which is reflected in the total transaction amount, increasing to RM11 billion compared to RM10.6 billion in 2017.

Overall, the number of properties transacted in 2018 totalled RM29.8 billion.

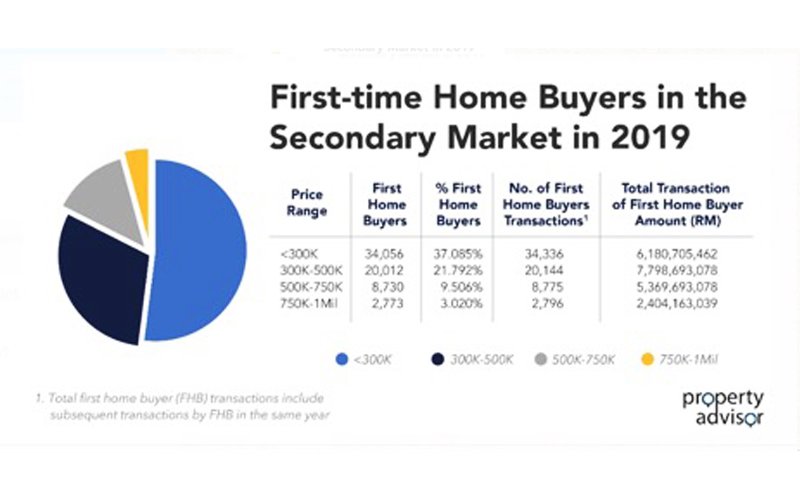

Despite the drop in volume, the FHBs for all price ranges saw a slight increase in percentages as compared to previous years. In total, the cumulated transaction value for 2019 totalled RM21.8 billion, lower than the previous years.

According to the PropertyGuru Consumer Sentiment Survey H1 2019, the ongoing oversupply of residential properties in Malaysia showed an increase in demand for the secondary market.

The survey showed there was a rise in overall interest in sub-sale properties to 62% from 47% in the secondary market.

According to data from the National Property Information Centre (Napic), the secondary market accounted for 80% of all property transactions in 2019.

The secondary market refers to previously owned properties while the primary market refers to new properties by developers.

* The data was derived from MyProperty Data analysis of over six million transactions. Property Advisor’s methodology was to calculate FHB analysis which excludes and adjusts based on a margin of error i.e. company names, “Kasih Sayang”/outlier value and half/partial shares.