As the year draws to a close, momentum continues to trend in the right direction in the U.S real estate market, says Knight Frank Malaysia associate director, international residential project marketing, Dominic Heaton-Watson.

Heaton-Watson said given the promising vaccine data and change in U.S. executive leadership consumer sentiment is increasing as evidenced by recent transactional data.

Buying opportunity is present, he said, adding that the US$1 million to US$3 million 'core' segment of the market, has held strong.

"Driven by continued investor demand, we see lower discount levels being achieved within this price range. Madison House, for example, a new development in Nomad, for which we are the sales representative has recently surpassed US$100 million in sales volume, despite the impact of the pandemic. Demand has been fuelled by the attractive starting price points, the building's full-service offering, and high-level finishes," Heaton-Watson said.

Located in the heart of Manhattan (between Midtown and Downtown), Maddison House, one of the fastest-selling new developments in New York City offers extraordinary views towards the Empire State Building and beyond.

Each residence features a unique corner exposure, 11 ft floor to ceiling windows, 75-ft pool, over 30,000 sq ft of dedicated club-style amenities, and 24-hour doorman and concierge service.

Imminently due for completion, prices start from US$1.48 million.

Heaton-Watson also sees great opportunities in the prime and super-prime segment of the market (US$5 million upward) where sellers and developers are negotiating on price and offering buyer incentives.

He said The Towers of the Waldorf Astoria, a luxury development, has received a phenomenal level of interest from buyers globally, despite launching sales at the very start of the pandemic.

Demand has been fuelled by the opportunity to acquire a true trophy asset on Park Avenue, he said.

"With the ability to purchase a studio or one-bedroom home under US$3 million, we have witnessed strong investor demand for smaller residences. As the market continues to strengthen and we start to see a reduced level of new development supply, it is likely we will not now see the dramatic fall in pricing that many were expecting.

"Average market-wide discount levels of 11 per cent are being achieved. As uncertainty decreases, we expect developer and seller discount levels to also decrease," he said.

Moving forward into 2021, Heaton-Watson picks out 2 themes - a strong focus on safe-havens and a strong focus on prime.

"We expect there to be a strong focus on safe-haven destinations, and a particular focus on markets that offer investors demonstrated resilience. New York City has always been considered a safe haven for foreign investment in uncertain times. To date, the U.S has been the leading destination for residential purchases from Asia Pacific buyers. As New York starts to recover, the fundamentals that the city's attractiveness as a global destination and store of wealth were built upon remain firm," he said.

Heaton-Watson also expects there to be a continued focus on prime assets in established 'blue-chip' locations such as Manhattan.

For clients in Asia that have acquired assets, a sight unseen in the past months, Heaton-Watson said they have been in prime locations such as Midtown, Central Park South, and Tribeca; in high-quality buildings that offer an exceptional finish quality and amenity offering.

"We have witnessed a 'flight to quality' and we expect this trend to continue," he added.

Most investments in the U.S.

Foreign investment into the U.S. is poised to grow as investors start to feel welcomed by new foreign policies, a positive economic outlook, and the potential of travel resumption in 2021, according to the Knight Frank New York Real Estate - Post US Election Update.

Heaton-Watson said despite a pandemic that paralysed global markets and a dramatic presidential election, the U.S. is demonstrating resilience and the promise of recovery in 2021.

"This post-election update has been produced to support our clients in Malaysia who may be looking to purchase in the U.S. in the coming months.

"As president-elect, Joe Biden sets to officially transition into office on January 20, 2021, his triumph will have profound implications on geopolitics and economies around the world. For foreign investors, his victory is likely to signal good news as the expectation of an improved economic outlook and sense of predictability is likely to boost investor confidence in the near term," he said.

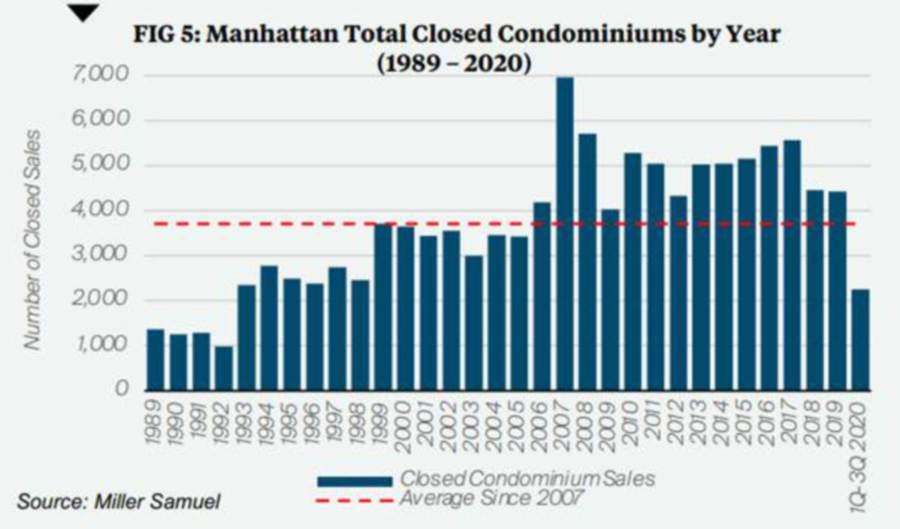

Heaton-Watson said further there have been four recessions over the past 30 years or significant events that have impacted the New York real estate market and data (throughout each recession) show that Manhattan real estate prices either remained level or recovered in a very short period.

He said sales rebounded significantly after the 1990-1991 recession.

Further, the burst of the dot com bubble in 2001, the aftermath of September 11, and the related recession that followed did not lead to a decrease in sales in 2002.

In fact, the economy rebounded quickly, leading to exponential sales growth.

"Data demonstrates that by 2013 sales prices had returned to previous highs reached in 2008, and by 2016 were 57 per cent higher than those in 2008. In summary, despite four significant market interruptions the New York real estate market has remained incredibly resilient and has bounced back, quickly.

"Despite the negative implications the pandemic has had on Manhattan transactional volume and pricing, we expect the market to strengthen as we move into 2021 and are already witnessing signs of this," he said.